Off-the-shelf Solutions

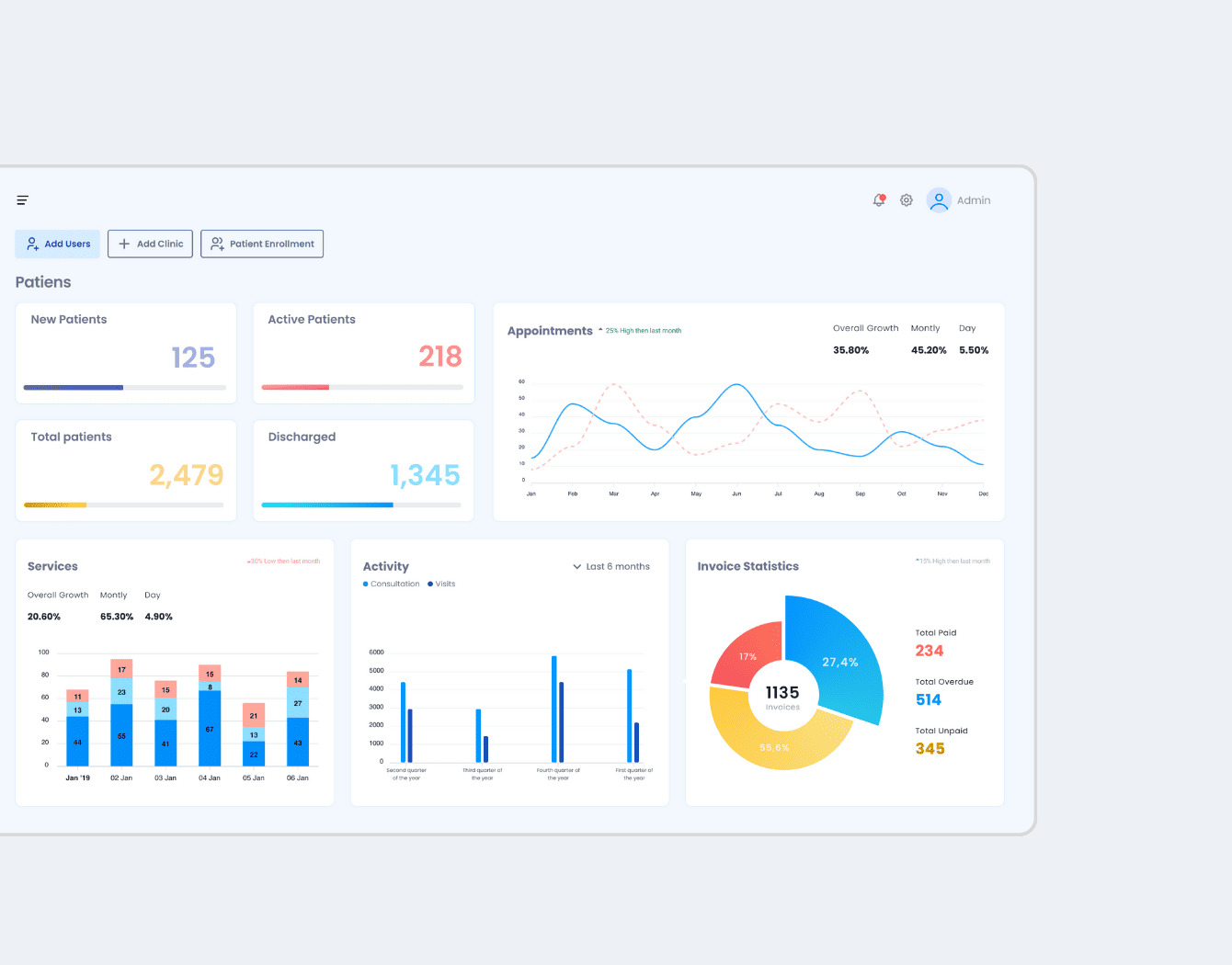

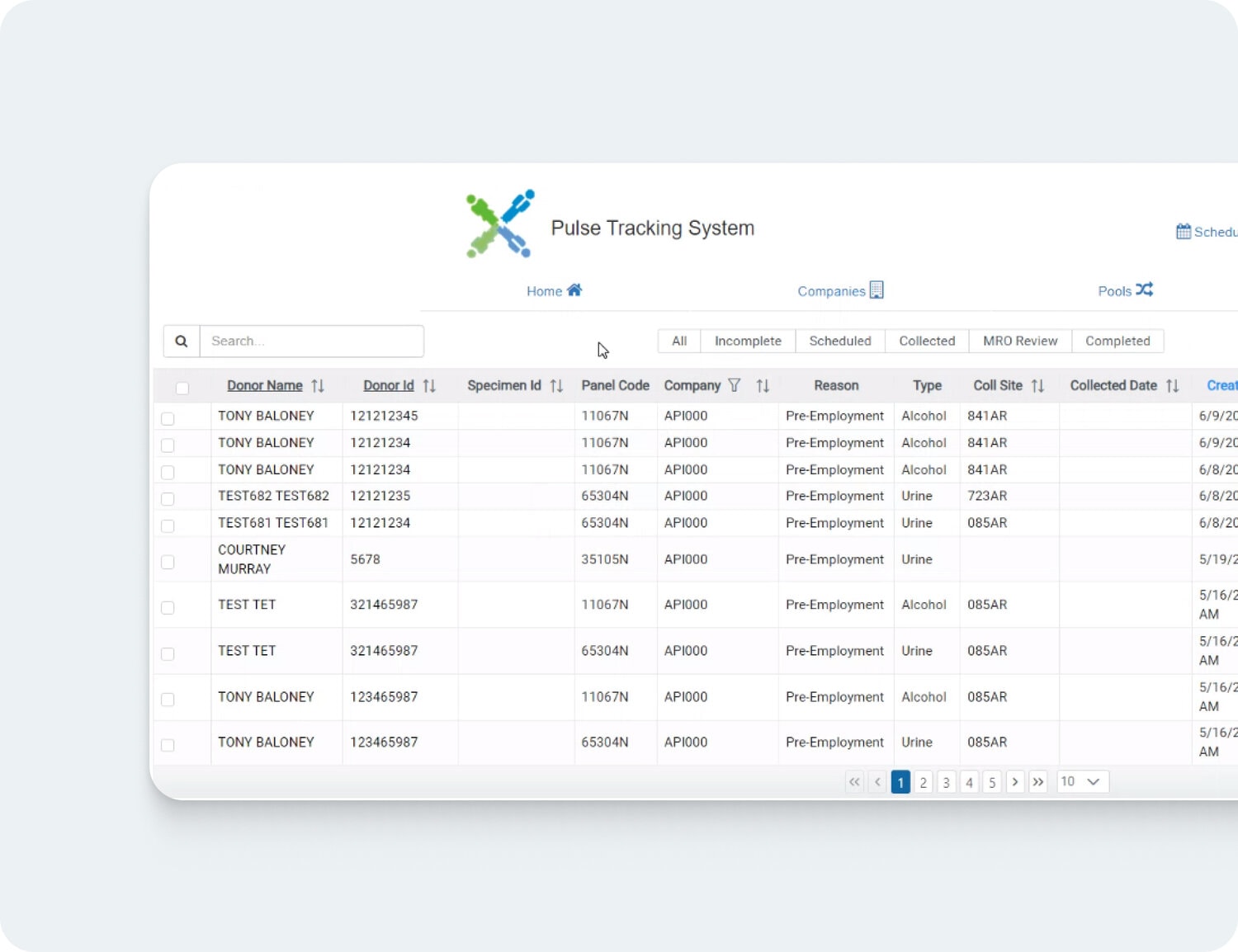

Custom-Developed Software

Vendor Dependence

High dependence on the vendor for support and updates.

Reduced vendor reliance, greater control over the software.

Security

Standard security features, potentially vulnerable to widespread exploits.

Tailored security measures, designed for specific business needs.

Ongoing Costs

Often involves recurring licensing fees or subscriptions.

Higher initial cost, but potentially lower long-term expenses due to customization.

Upgrades

Upgrades are vendor-driven, may not align with business needs.

Upgrades are controlled by the business, tailored to specific requirements.

Ownership

The software is owned by the vendor, with usage rights granted to the business.

The business owns the software, offering complete control over its use.

Functionality

Generalized features designed to meet the needs of a broad market.

Customized functionality that aligns precisely with business processes.

Integration

May have limited integration capabilities with existing systems.

Can be designed for seamless integration with existing business systems and processes.