The Client

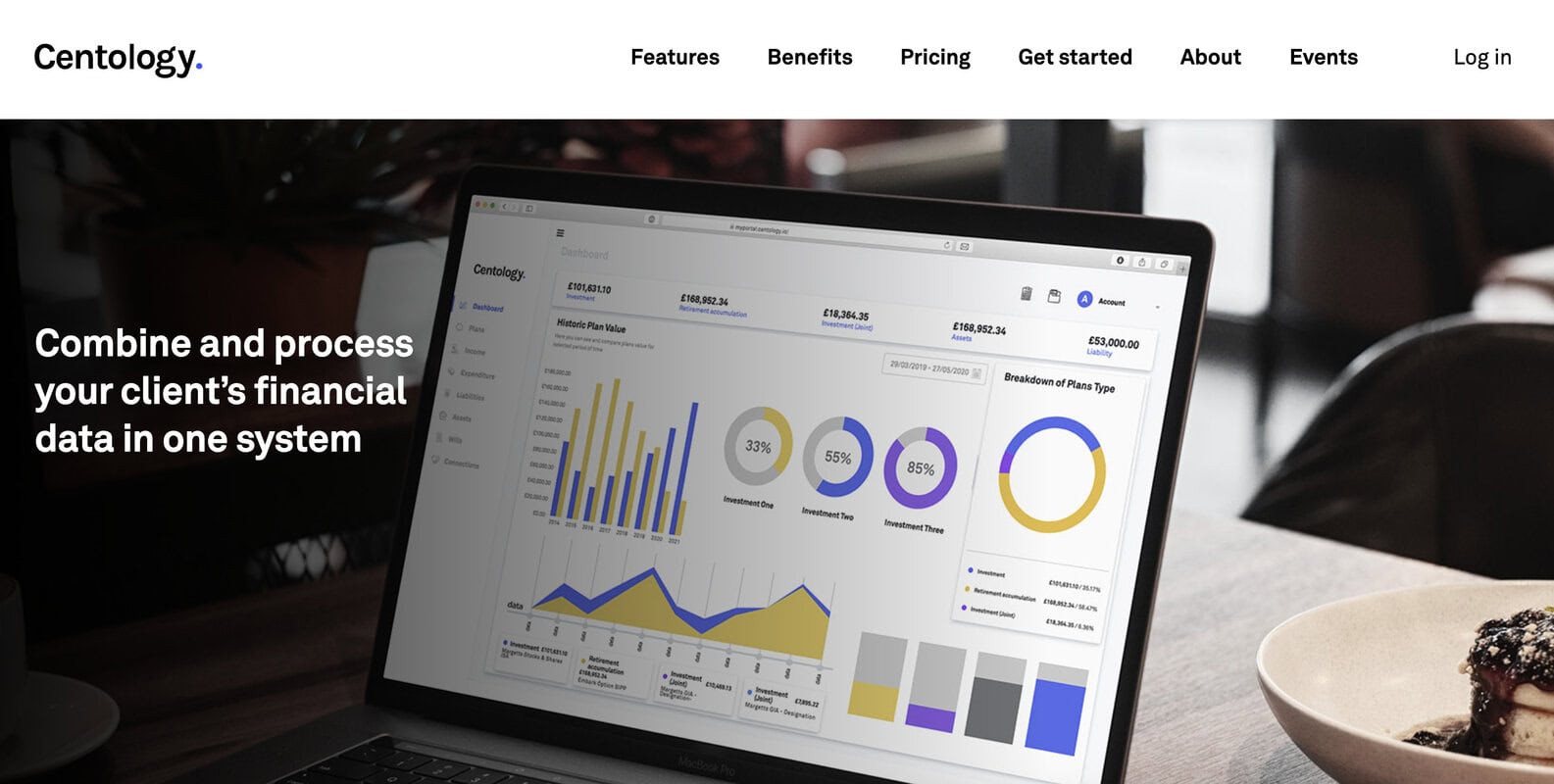

IFS Centology is a software platform from the UK that helps financial advisors work better with their clients.

IFS serves both independent financial advisors and advisory firms, and offers a white-label SaaS solution that spans the entire client lifecycle, from lead generation and onboarding to financial profiling, strategy execution, and performance tracking.

The platform is tailored to the unique regulatory and tax frameworks of the UK, and accomodates various pension structures and risk profiles.

Visit the website

From day one, we were co-designing a solution that aligned with IFS’s operational model and long-term goals.

The product was structured as a white-label SaaS platform, targeted both at financial advisory firms and so-called “sandwich companies” who deliver end-client services. Our focus was on flexibility and speed

Modular Architecture

We designed a modular architecture to handle rapid changes in financial legislation and customer needs.

Continuis Business Operation

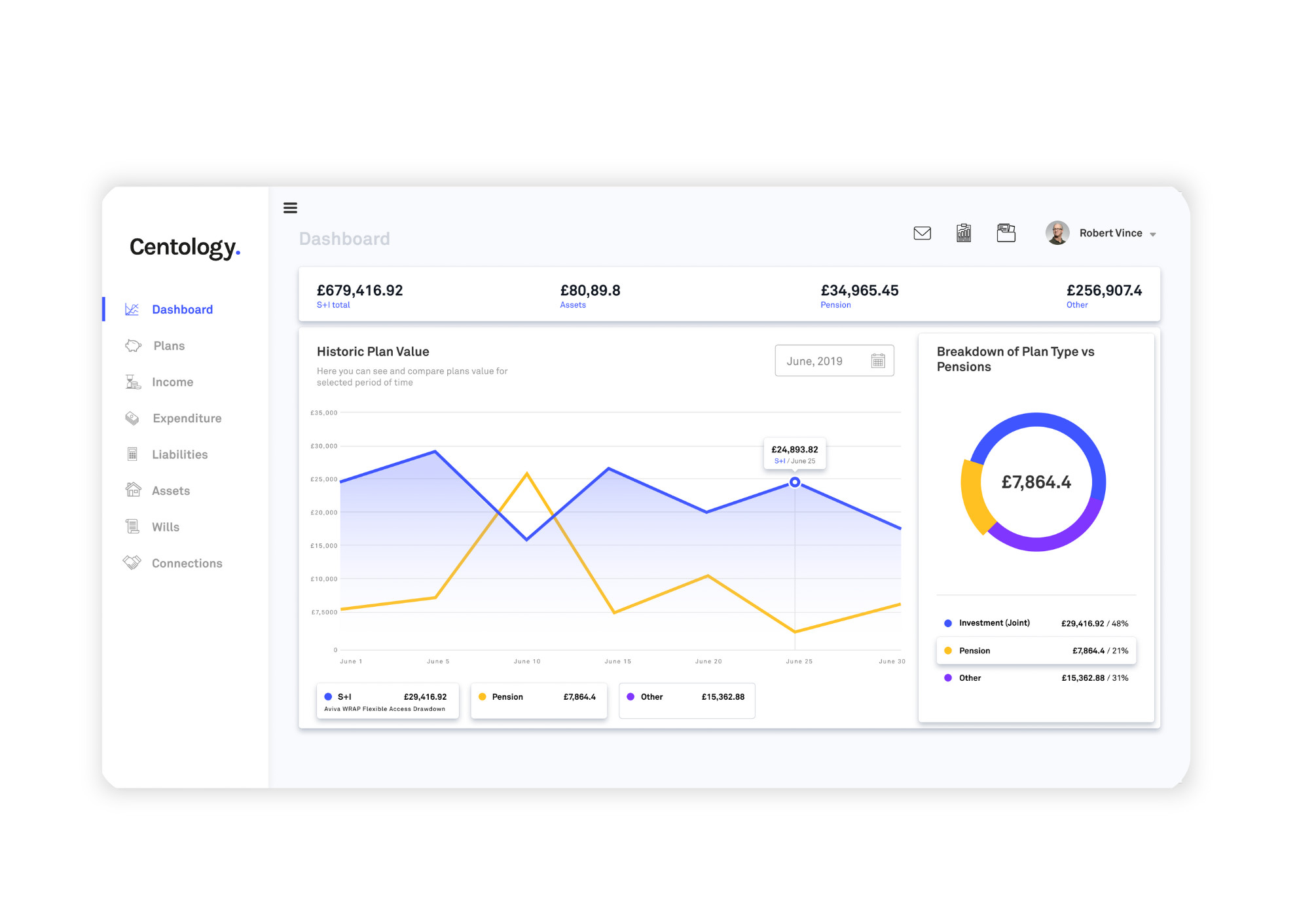

we ensured the system could process diverse types of client data, from assets and income to detailed investment history

Hybrid Project Methodology

We used a hybrid project methodology combining Scrum and Kanban, supported by tools like Jira, Confluence, TestRail, and Figma.

Weekly Meetings

Our team met weekly to plan releases, prioritize features, and stay aligned across development, QA, design, and business analysis.

Challenges

CRM Migration Risks

The transition from an old CRM system to a new custom-built one had to be done without disrupting service to end users.

High Expectations for Customization

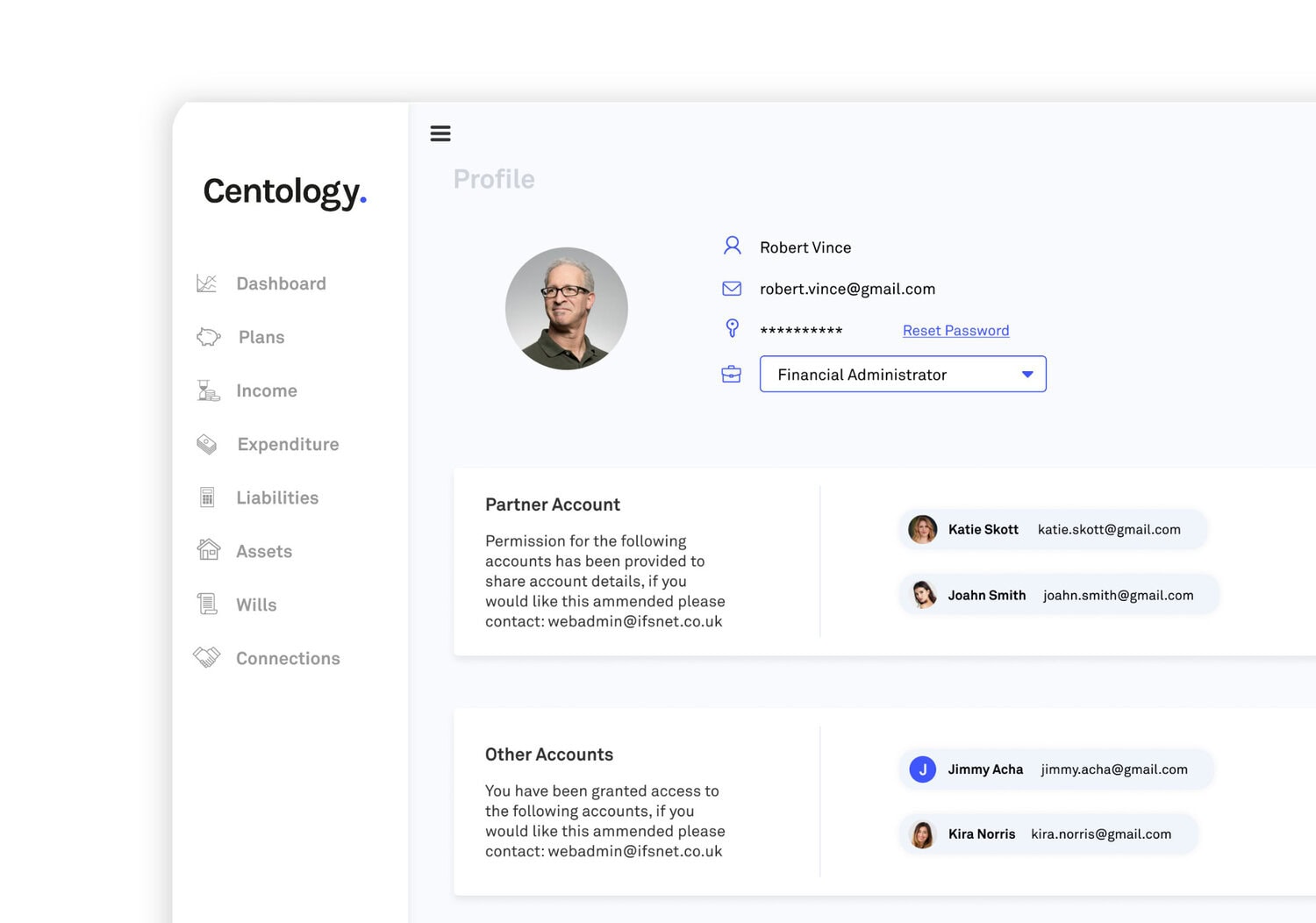

Clients expected tailored solutions based on risk tolerance, asset types, and personal goals.

Fragmented Dashboards

Outsourced dashboard components lacked transparency and caused integration delays.

Technical Debt and Time Pressure

Years of iterative updates had created a brittle architecture. Developers were constrained by budget and time, often forced to deprioritize code refactoring, leading to accumulated technical debt.

Dynamic Forms

Since advisors work with a wide array of client-submitted documents, mostly unstructured PDFs, we created dynamic form tools with strong validation rules. These forms are central to the advisory workflow and require deep back-end connections to a web of interrelated data tables.

What started with a small development crew grew into a 13-person engineering team by 2025.

We took over legacy systems, replaced unreliable external vendors, and currently delivering a robust proprietary platform.

40–50% faster system performance thanks to a complete architectural rewrite

3 rounds of UX/UI improvement, driven by client feedback and user behavior.

10+ hours saved weekly through automated report generation

1600 autotests that cover 90% of the functionality

Over $568,000 in QA cost savings

through test automation, which reduced regression testing from two months of manual work to just a few hours.

Why it Worked

Discovery Process That make Development 30–40% More efficient

- Document every feature request to prevent miscommunication and ensure mutual understanding.

- Conduct small-scale discovery for each new feature to avoid hidden pitfalls and align expectations.

- Communicate regularly, even when there’s “nothing new,” to keep the client informed and engaged.

- Plan features with cost awareness, often delivering 30–40% more efficient alternatives to initial proposals.

Final Thoughts

Eight years into this partnership, IFS has a platform that meets the demands of today’s financial advisory landscape and evolve with it.

Rather than chasing innovation for its own sake, the team focused on practical improvements that delivered measurable value: time saved, costs reduced, and systems that simply work better. This approach earned long-term trust from the client and created a foundation for future growth.